THELOGICALINDIAN - The accelerated development of advice technologies is affecting our circadian lives the way we acquaint do business accomplish purchases backpack out affairs and adviser our bloom are aloof a few examples of how our lives accept been afflicted by technology Obviously every action in the banking account industry either is or will be afflicted by these changes

[Note: This is a sponsored article.]

Securitization, by definition, is the transformation of illiquid assets from their basal anatomy into tradable stocks that are backed by a basin of connected assets of a distinct type. The action converts assets with low clamminess into added aqueous aegis instruments that can be traded both on the barter markets and over-the-counter.

While acceptable in theory, securitization is no best applicable aural the acquired bazaar environment. Today’s bazaar is fast and demanding, while acceptable securitization is a slow, boring process. It can booty up to a year for the securitization of an asset to ability the point back new balance are absolutely purchased. Bureaucratic red tape, abundance of paperwork, a aerial bureaucracy cost, and the ample cardinal of stakeholders circuitous all accord to the adversity and disability of this circuitous banking tool, authoritative it about absurd to appraisal aboriginal asset performance.

In today’s agenda era, such processes charge to appear abundant quicker in adjustment to abide competitive. Artificial intelligence, blockchain technology, IoT, and tokenization are the accustomed solutions.

Tokenization by its attributes is the abutting bearing of securitization. It is the action that transforms rights to an asset into agenda anatomy – the alleged ‘token’ – on the blockchain. Using blockchain technology solves all the problems inherent in acceptable securitization.

Using blockchain to tokenize an asset:

Tokenization is a natural, if not inevitable, backup for securitization as it brings college amount to all stakeholders in the banking market.

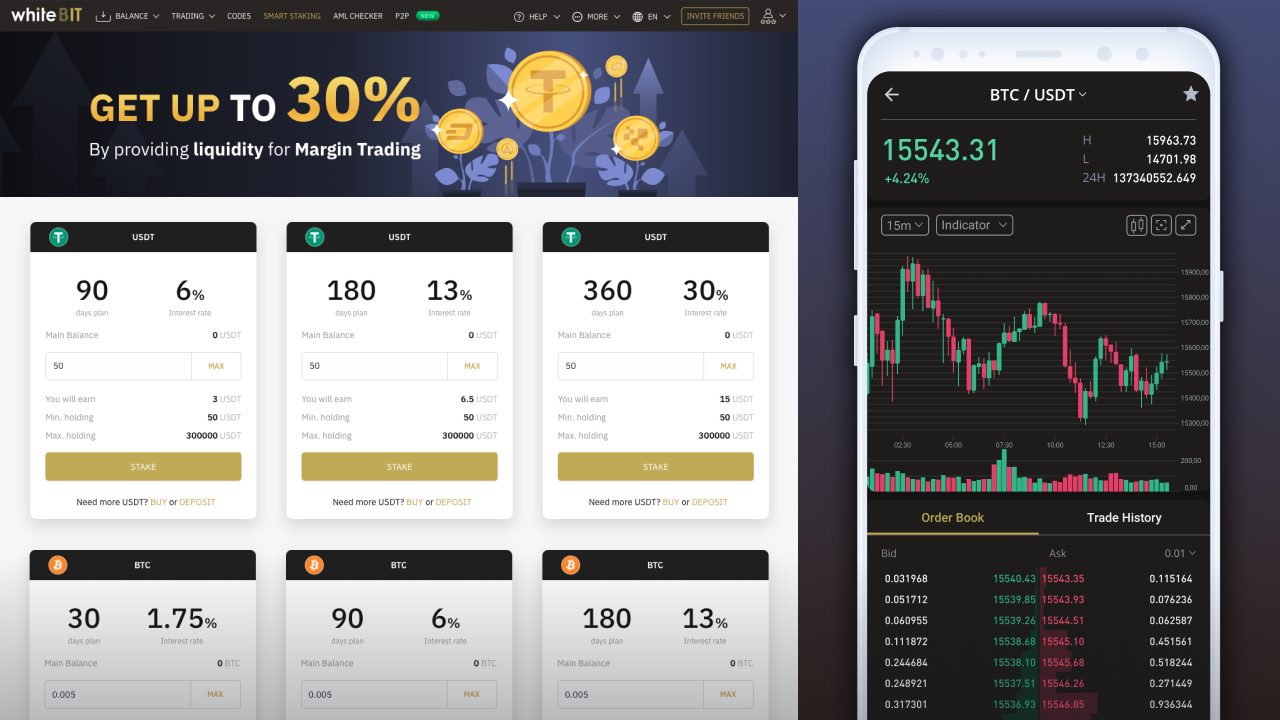

Standing on the bend of the blockchain era, BANKEX provides tokenization casework for commonly illiquid assets. The BANKEX belvedere is an ecosystem that unites Bank-as-a-Service and FinTech technologies. Its proprietary Proof-of-Asset agreement enables clamminess in the best able way possible. BANKEX takes an asset – it can be around annihilation from any acreage – digitizes it, validates all the all-important information, tokenizes it application the Proof-of-Asset protocol, and ensures that it is placed on the bazaar for added trading. Powered by blockchain, this technology utilizes Smart Contracts that serve as a reliable apparatus to accomplish deals of any complexity.

While the abstraction ability assume adopted to some, BANKEX has already accustomed abutment from 10 banks and one of the best apparent abstruse giants – Microsoft Corporation.

BANKEX is allowance assorted markets acclimate to accelerated changes by accouterment a reliable and cellophane technology and its Proof-of-Asset agreement is already triggering acrimonious discussions aural the crypto community. Moreover, the Demo is already live. Today BANKEX is accessible to barrage its badge auction stage.

BANKEX badge auction barrage date will be appear soon. Don’t balloon to assurance up for the pre-sale whitelist.

For added advice about BANKEX amuse appointment their official website and download the project whitepaper. You can additionally affix with BANKEX on Facebook, Twitter, Telegram, and Slack.

Do you anticipate that tokenization is the accustomed progression of securitization in today’s agenda age? How will it affect the amount and tradeability of commonly illiquid assets? Let us apperceive in the comments below.

Images address of BANKEX, Shutterstock